When does the customer first ask about price? Pricing part 2.

When does the customer first ask about price? Pricing part 2.

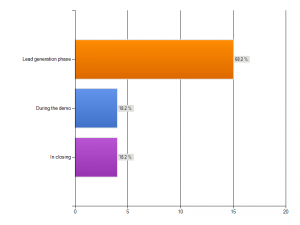

From our recent survey on pricing we found that 60% of customers raised price during the lead generation phase. Only 18% of sellers were able to position value so that the price issue was not raised until the closing/negotiation stage. Even though 70% of the companies do not post prices on their website, they are expecting that when the sales people engage with the client that they would be able to frame price and value.

I wish this were so. Hope is not an strategy. We see that price is raised early most often due to a misalignment of the marketing and sales stories plus a lack of sales tools for communicating customer value. So price defaults to the early discussion. The company is letting the customer “deduce’ value and set a reference price. This can be a rapid road to commoditization of your products (much beloved of corporate purchasing departments) and a slide in the margin for your products. I believe most companies are guilty of leaving a lot of money on the table by selling their product for too little.

It does not have to be so. In the above survey, 18% of the companies were able to control the discussion longer, so that the sales group would have more opportunity to extract and show the customer the business value of the product. In our practice, we are able to quickly grow sales force and marketing expertise in these areas. We do it through providing more compelling value messages for all the different organizational buyers plus providing tools and tactics to help the sales group pull these buyers through the sale, to preserve the value of your products. Its just that simple.

Related articles

- Practical Pricing. Translating pricing theory into sustainable profit improvement. Michael Calogridis. (regnordman.com)

- The Real Growth Driver: Blending Commoditization and Differentiation (leveragepoint.com)

- A Pair of Killer Pricing Articles for Startups (enterpriseirregulars.com)

- Five Pricing Tips For Small Companies (blogs.forbes.com)

- The Competitive Edge: Differentiating Your Product or Service (pamil-visions.net)

- Why Customers and Suppliers Collide: Part 2 – The 4 Phases of the Buying Cycle (customerthink.com)

Category: Marketing, Pricing, Sales, Sales Effectiveness

Does finance still set your prices? Pricing panel part 7.

- Image via Wikipedia

Does finance still set your prices? If this is true, its time to get into a more recent century. Along with this, lazy companies often set their prices as cost plus – which according to Thomas Nagle, under prices for some customers while penalizing others. In my experience cost plus pricing was used to set a list price, which no sales guy ever followed. Every customer received some form of discount along the way from order to delivery. Forrester tells us 95% of customers get a discount.

Another sin is being unable/unwilling to track all initiatives, contracts, and discounts all the way through each transaction. This is used in the concept of a price/margin waterfall. In essence the company does not really know how much profit it received from every transaction. How do you know which clients are “at risk” for being poached and which ones are chronic “outlaws” in getting maximum discounts if you do not track full transaction margin? Bringing some up to date financial controls to this area will result immediate profit uptakes. Plus Finance will be able to play a proactive role in your pricing strategy.

Related articles

- Pricing survey indicates you are dropping prices, but for the right reasons? Part 1. (regnordman.com)

- The Strategy and Tactics of Pricing. A guide to growing more profitably. Thomas T. Nagle, John E. Hogan, Joseph Zale. (regnordman.com)

- Practical Pricing. Translating pricing theory into sustainable profit improvement. Michael Calogridis. (regnordman.com)

- Does Price Matter Most? (businessinsider.com)

- The Impact of Finance on Business Growth (thinkup.waldenu.edu)

- What generates the highest profit margin, product or service? Pricing part 3 (regnordman.com)

- Pay Cash, Get Discount? (online.wsj.com)

- Customer history, is it helpful in raising prices? Pricing part 5. (regnordman.com)

- When does the customer first ask about price? Pricing part 2. (regnordman.com)

- Should the “Competitive Leadership Model” Really Be “The Value Leadership Model”? (leveragepoint.com)

- Is price raised at the beginning of your sales process? Pricing panel Part 6. (regnordman.com)

- Pricing Strategy for Rainmakers (avantrasara.com)

Category: Finance, Management, Pricing, Technology Industry

You Already Know How to Be Great. A simple way to remove interference and unlock your greatest potential. Alan Fine

- Image via Wikipedia

You Already Know How to Be Great. A simple way to remove interference and unlock your greatest potential. Alan Fine. 2010. ISBN 9781591843559. Fine is a proven coach in many sports and business situations . He knows what he is talking about.

This is an important book. vs telling /coaching what to do is quite profound. I tried his ideas while reading the book and found it to be immediately beneficial in client work. His GROW process, while not unique – Goal, Reality, Options, Way Forward, is simple enough to be easy to use in any situation. Clearly written in a friendly, anecdotal style makes this a good read. More at www.alan-fine.com and www.insideoutdev.com

Related articles

- Jack Covert Selects – You Already Know How to Be Great (800ceoread.com)

- Your Transformation Playbook: You Already Know How to Be Great (converstations.com)

- ChangeThis: Issue 75 (800ceoread.com)

- The Week’s Hottest Reads: Publishers Weekly Bestsellers (huffingtonpost.com)

Category: Leadership, Lifeskills