Dark Pools.High speed traders, AI bandits, and the threat to the global financial system. Scott Patterson.

Dark Pools.High speed traders, AI bandits, and the threat to the global financial system. Scott Patterson.2012. ISBN 9780307887177. Patterson wrote The Quants which I enjoyed so I was looking forward to Dark Pools. It does not disappoint. He has the gift of rendering what could be numbingly arcane facts and numbers into a very compelling book that reads like a novel. I read it in one sitting – it is that good. His focus on the people involved is appreciated by the reader. That all said, this is not a comforting book. The system is rigged against us, the little investor, over the short and long haul. You do find out how these wizards make the money on the backs of others. You end up with second thoughts as to why anyone still puts money into stocks. A must read for anyone who interested in how their money works…for others through the use of very advanced computers and machine learning

Related articles

- The Dark (Pool) Truth About What Really Goes On In The Stock Market (zerohedge.com)

- The Dark (Pool) Truth About What Really Goes On In The Stock Market: Part 3 (zerohedge.com)

- Scott Patterson: Is the Stock Market Rigged? (Excerpt) (huffingtonpost.com)

- The 500 Dark Pools (stevenpressfield.com)

- Reasons to fear Wall Street’s high-tech traders (features.blogs.fortune.cnn.com)

- Taking The Market Out Of The Market (seekingalpha.com)

Category: Finance, Strategy, Technology Industry

The Unfair Trade. How our broken financial system destroys the middle class. Michael J . Casey

The Unfair Trade. How our broken financial system destroys the middle class. Michael J . Casey. 2012. ISBN 9780307885302. As managing editor of the Wall St Journal, Casey has a cat bird seat on the world economy. This is an eminently readable book, which presents a reasonably balanced view of what happened, who pulls the strings and what mistakes were made y govt and business world wide. But, and this is why I like it when journalists write these books, Casey points out what we can do looking forward. As investors this is a good book to use to measure govt responses and help plan your own moves.

One good point made is that China’s internal credit and currency policies have exported deflation to the rest of the world, by killing off sections of our economies. If they stumble ( and many expect they will) .Australia, Brazil, South Africa, Indonesia and Canada will have massive resource sales slowdowns followed by big economic hits, which could trigger social disruption.

Another is that the massive debt burdens in Us and Europe will restrain growth in those economies for decades, forcing investment into the stoked up younger economies in the pursuit of profits.

His suggestions?

- Stop backing the to-big-to fail banks by having a capital surcharge which will force them to break up . as well we shoudl look to Iceland which forced the bankers and bank shareholders to take the hit. Governments should protect taxpayers not bankers.

- Oust the US dollar as the world reserve currency. This will force US to live more within its means and help politicians to make the tough decisions.

- Force hedge fund managers to be personally liable for their client’s losses.

Related articles

- Michael Casey’s FX Horizons: Imagining an end to the dollar’s reign (marketwatch.com)

- The Global Financial System and the Middle Class (wnyc.org)

- Michael Casey’s FX Horizons: ‘Developed’ Greece a model of dysfunction (marketwatch.com)

- You Can’t Just Blame Europe For Our Economic Slow Down (businessinsider.com)

- Canada’s debt-fuelled economy running on fumes, Carney warns (business.financialpost.com)

- How The Mining Boom Is Making Australians Dumber (businessinsider.com)

- Michael Casey: One Man’s Escape From Debt-Collection Hell (Excerpt) (huffingtonpost.com)

- Who Destroyed the Middle Class – Part 3 (economicnoise.com)

- Who Destroyed America’s Middle Class? Dude, Who Stole My Net Worth? Part II (globalresearch.ca)

- China’s Missing Middle Class – Analysis (eurasiareview.com)

Category: Finance

The Speed Traders. Edgar Perez. A guest post by Nora McCallum of Scotia McLeod

The Speed Traders. Edgar Perez. A guest post from Nora McCallum of Scotia McLeod. 2011. ISBN 978-0071768283

Reg, thanks for passing along “The Speed Traders” by Edgar Perez. I enjoyed reading this book. Most of the research to date demonstrates that HFT’s (and hedge fund managers for that matter) can have a period of very high success but ultimately fail. The extinction ratio for this investors class is very high. I think that the book gives a clear and concise overview of the (short) history and current role that High Frequency Trading plays in the capital markets. Given that speed is of the essence with this tool, I am not sure how much more time can be shaved off the technology; it will be very interesting to see how these trading techniques continue to develop and influence the global capital markets.

Related articles

- Crapshoot Investing: How Tech-Savvy Traders and Clueless Regulators Turned the Stock Market into a Casino (ritholtz.com)

- The Future and Challenges for High-Speed Trading at High-Frequency Trading Leaders Forum 2011 (your-story.org)

- The future is all about cross-asset arbitrage (ftalphaville.ft.com)

Category: Finance

Training your customers for regular price increases. Pricing part 12

- Image by Getty Images via @daylife

Training your customers for regular price increases. Pricing part 12. If you want to be one of the successful companies who are able to regularly raise prices, through value selling plus other methods you have to start now. Start when they first become a new customer. i.e. start Day1 by reinforcing how to prevent late fees, change of terms costs, change order costs, decision delay charges, partial ordering charges and so on.

Use psychology 101.

- Stepwise small price increases are more palatable than one large one.

- The power of 9 still reigns in setting price (sets a reference price).

- Large cuts are seen as better than a series of small ones (increase the perception of saving).

- Humans love to see that they have avoided a cost versus having one forced on them ( The sense of something gained vs something lost).

- Take an offer away when you say you will. ( Increase sense of loss)

- Communicate your price increases many months ahead – see what the competition does

Use the power of stories

- The need for vendors to remain viable

- A mutual need for survival

- All competitors will be treated equally

Be prepared for those who went to buyers school (e.g. Lowes, WalMart, IKEA, Safeway)

- Run lots of “what ifs” prior to any large bids/contracts

- Never volunteer you give price exceptions

- Resist being bulled – cause they will try to

- Maintain price integrity

- Be ready to walk – they are talking to you because they want something from you.

- Be prepared to let someone else go broke selling to them

Related articles

- Home Insurance – price increases (politics.ie)

- What Happened to Wal-Mart’s Low Prices? (fool.com)

- Five Pricing Tips For Small Companies (blogs.forbes.com)

- Safeway Deflates Its Way to a Profit (fool.com)

- Every Day Low Prices: The Real Story of Wal-mart (socyberty.com)

- When does the customer first ask about price? Pricing part 2. (regnordman.com)

- Osaka Titanium to Increase Prices on Aviation Demand (businessweek.com)

- Bloxx knocks rivals’ price hikes (channelweb.co.uk)

- Pricing survey indicates you are dropping prices, but for the right reasons? Part 1. (regnordman.com)

- What generates the highest profit margin, product or service? Pricing part 3 (regnordman.com)

- Make Customers Pay Extra With a Great Customer Experience (customerthink.com)

- The Competitive Edge: Differentiating Your Product or Service (pamil-visions.net)

- Customer history, is it helpful in raising prices? Pricing part 5. (regnordman.com)

- Examples of Companies That Use Cost Leadership Strategies (thinkup.waldenu.edu)

- Wal-Mart Is Offering Free Online Shipping To Increase Sales (lockergnome.com)

- Top Five Ways to Waste Your Time and Money When Selling Your Business (prweb.com)

Category: Communication, Finance, Leadership, Management, Marketing, Pricing, Sales

So what can a CEO, Marketer, Salesperson, or CFO do to improve your pricing? Pricing part 11

So what can you do to improve your pricing? Pricing part 11. Tips if you are a CEO, Marketer, Salesperson, or CFO

What can a CEO do?

- You are the holder of common sense. Does the pricing policy ( you do have policy? ) make sense to the customers?

- Manage the change process expectations. Of course it will take time and hard work.

- Set up cross functional teams to set your pricing policy

- Keep your marketing dept focused on maintaining constant deep market research

- Move to pricing excellence, not blaming sales and marketing.

What can the CFO do?

- Track the price waterfall for individual transactions, especially Outlaw customers

- Track contract compliance by customer

- Monitor discounts ( discount creep) including unplanned ones. *(eg extended credit, missed deadlines, rebates, one time promos, signing bonus, partial shipments and so on

- Have quarterly analysis on pricing initiatives given to sales/marketing to track real impact on net profits

- Keep long term look aheads on pricing trend and impacts

What can marketing do?

- Be on top of the value drivers (stories) for every stage of customer progress through engagement, buy and close.

- Manage communications to ensure price changes are open, transparent and believeable.

- Test before you deploy

- Create templates, policies, and documentation to support value selling by sales.

What can sales do?

- Actively create and train on tactics and tools to demonstrate and maintain value through the sales process.

- Collect supporting customer stories, competitive data, and validate buyer stories. get this back to marketing.

- calendar tender and contract expiry dates – Pre call proactively and early.

Resources.

- Strategy & Tactics of Pricing – 5th ed. Thomas T. Nagle

- Practical Pricing. Michael Calogrides. 2010

- Sixteenventures.com

- McKinseyQuarterly.com

- http://marketreadiness.blogspot.com

- http://www.strategy-business.com/article/16333

Related articles

- Solicit Sales Feedback Marketers Can Use (customerthink.com)

- How to Manage a One-Person Sales Force (inc.com)

- When does the customer first ask about price? Pricing part 2. (regnordman.com)

- Hiring Your First Salesperson: How to Pass the Torch (entrepreneur.com)

- The Strategy and Tactics of Pricing. A guide to growing more profitably. Thomas T. Nagle, John E. Hogan, Joseph Zale. (regnordman.com)

- Customer history, is it helpful in raising prices? Pricing part 5. (regnordman.com)

- Your Company culture often works to resist raising prices. Pricing part 4 (regnordman.com)

- Are you still using Groupthink to set prices? Pricing panel 8 (regnordman.com)

- Pricing survey indicates you are dropping prices, but for the right reasons? Part 1. (regnordman.com)

Category: Finance, Leadership, Management, Marketing, Pricing, Sales

Built to Sell. Turn your business into one you can sell. John Warrillow.

Built to Sell. Turn your business into one you can sell. John Warrillow. 2010. ISBN 9780986480300. Written as a business story, this is written as a clear blueprint for anyone owning a service business to turn his “baby” into a sellable product company. If you already have a product company, there is still a tremendous amount of work involved to make it salable. Well written, with very clear guidance and metrics presented to the reader. You will rip right through this one, but it hits well above its weight class. This is due to the success of the author in selling his own businesses.

Related articles

- Personal Branding Interview: John Warrillow (personalbrandingblog.com)

- What’s Your Number? (inc.com)

- 4 Reasons Big Companies Buy Little Ones (inc.com)

- Sabbatical by the boss leads to attempted takeover (theglobeandmail.com)

- Three ways to find out what your business is worth (theglobeandmail.com)

- Trader Joe’s flirts with being bigger over better (theglobeandmail.com)

- How to Build a Bulletproof Company Culture (inc.com)

- In side a $25 million game of chicken (theglobeandmail.com)

- Test your company’s value by going on vacation (theglobeandmail.com)

Category: Finance, Leadership, Management

Why Buffett and Gates will not get that much charity donating in Asia.

Why Buffett and Bill Gates will not get that much charity donating in Asia. This is simple. (Lessons learned from working with Vancouver’s Asian run companies ) The Asian mindset is focused on the family. There is such an age long bond to family that to think about “giving” funds outside that is not part of the culture. If you want to approach charity fundraising in this market consider two must-have answers to business questions. (If you do not do this, there is no way to start to meet the givers needs.)

- Is this charity a good thing? Is it a good thing that they do? How does it help? Who does it help? What is the societal benefit of this? Why is that a good thing? Do not assume the audience shares your belief in the intrinsic good of giving or that saving lives in some far off country is important.

- What will the individual get out of the gift? What type of recognition is planned? Photo op? Celebratory dinner? Plaque for his office wall? Laudatory newspaper article? Do not make the mistake of the photo of Gates shaking the donor’s hand happening before the cheque clears the bank.

Also remember the preservation of face. By attending a fund-raising event will the potential donor be pressured socially to give? The fear of that is likely to prevent many from attending.

- Cover of Bill Gates

- Image via Wikipedia

Related articles

- Gates, Buffett Talk To China Wealthy About Charity (huffingtonpost.com)

- Gates and Buffett Say Charity Meeting a Success (dealbook.blogs.nytimes.com)

- Chinese billionaires accused of stinginess after charity banquet snub (guardian.co.uk)

- US billionaires Gates, Buffett impressed by passion among China’s wealthy for charity (taragana.com)

Category: Communication, Finance, Marketing

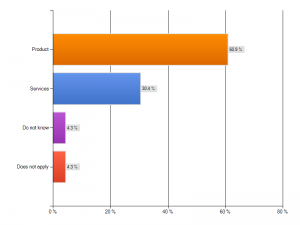

What generates the highest profit margin, product or service? Pricing part 3

What generates the highest profit margin, product or service? Pricing part 3.

This was a surprising data point from our Oct 2010 survey on pricing. I was expecting that the impact of product commoditization, SaaS, web apps, tied freemium offers and the ample opportunity to up sell present clients would have made an impact on the survey from other times. Most analysts say that products are being commoditized and true value is coming from services. But it seems not.

Mature companies like SAP and Oracle are able to create huge profits from their services group. IBM has swung the majority of its revenue with huge profits from services. Best Buys Geek Squad has bigger profits than the stores (its a growth department and they generate 60 % of income on products that come from competitors) .

At Rocket Builders we see in this data a reflection of a less mature approach to the market and ultimately pricing errors due to poor value communication in the surveyed companies. Yes, the technology community is a youthful one , but the companies have been around for a good length of time through many cycles, with ample opportunities to build more mature business models.

A company might have very valid reasons for not getting more margin from a services group. Perhaps:

- The customers say they will not pay for services

- The competition does not charge for service

- Its part of a short term penetration strategy

- The services may not be valuable

- There are no salable services

Perhaps you have lower services margin for preventable reasons such as:

- You do not up sell services

- You do not track margin erosion through the services group

- You “toss” services in with the product sale

- You never thought about it

- You do not know how to do that

- Its part of your history and culture

- You do not grow your services departments soft skills and technical expertise

- Your customer experience is just not that great

- Field services does not sell

Service revenue should be a large and growing profit center for a well run company. It requires current customer knowledge and the extraction of the value you help a customer get out of your solution. But these are areas where knowledgeable and experienced marketing and sales departments can really bring the value stories back to the services department. Customer testimonials are the gold that will fill your mint.

Not getting the profits you deserve is preventable. If you want to know more about how to get more value for your services, give Rocket Builders a ring. Bringing out customer value is what we do every day.

Related articles

- 6 characteristics of successful Freemiums (techvibes.com)

- The Competitive Edge: Differentiating Your Product or Service (pamil-visions.net)

- What IS Your Position On Customer Service? (customerthink.com)

- 3 Tips for Cross-Selling and Upselling Success (customerthink.com)

- UPDATE 1-Gentex says profits jump but margins squeezed (reuters.com)

- Will Herbalife Earn or Burn? (fool.com)

- 5 Traits of Great Stocks (fool.com)

Category: Finance, Marketing, Pricing, Sales, Technology Industry

Does finance still set your prices? Pricing panel part 7.

- Image via Wikipedia

Does finance still set your prices? If this is true, its time to get into a more recent century. Along with this, lazy companies often set their prices as cost plus – which according to Thomas Nagle, under prices for some customers while penalizing others. In my experience cost plus pricing was used to set a list price, which no sales guy ever followed. Every customer received some form of discount along the way from order to delivery. Forrester tells us 95% of customers get a discount.

Another sin is being unable/unwilling to track all initiatives, contracts, and discounts all the way through each transaction. This is used in the concept of a price/margin waterfall. In essence the company does not really know how much profit it received from every transaction. How do you know which clients are “at risk” for being poached and which ones are chronic “outlaws” in getting maximum discounts if you do not track full transaction margin? Bringing some up to date financial controls to this area will result immediate profit uptakes. Plus Finance will be able to play a proactive role in your pricing strategy.

Related articles

- Pricing survey indicates you are dropping prices, but for the right reasons? Part 1. (regnordman.com)

- The Strategy and Tactics of Pricing. A guide to growing more profitably. Thomas T. Nagle, John E. Hogan, Joseph Zale. (regnordman.com)

- Practical Pricing. Translating pricing theory into sustainable profit improvement. Michael Calogridis. (regnordman.com)

- Does Price Matter Most? (businessinsider.com)

- The Impact of Finance on Business Growth (thinkup.waldenu.edu)

- What generates the highest profit margin, product or service? Pricing part 3 (regnordman.com)

- Pay Cash, Get Discount? (online.wsj.com)

- Customer history, is it helpful in raising prices? Pricing part 5. (regnordman.com)

- When does the customer first ask about price? Pricing part 2. (regnordman.com)

- Should the “Competitive Leadership Model” Really Be “The Value Leadership Model”? (leveragepoint.com)

- Is price raised at the beginning of your sales process? Pricing panel Part 6. (regnordman.com)

- Pricing Strategy for Rainmakers (avantrasara.com)

Category: Finance, Management, Pricing, Technology Industry

Practical Pricing. Translating pricing theory into sustainable profit improvement. Michael Calogridis.

- Image by Getty Images via @daylife

Practical Pricing. Translating pricing theory into sustainable profit improvement. Michael Calogridis.2010. ISBN 9780230614604. A different book on the subject than Thomas Nagles. Calogridis gets you very quickly into the hows of pricing and gives the reader very useful tools to display the concepts to others clearly and efficiently. It works well as a first serious book on pricing and reads quickly and easily. I really enjoyed his “here’s how to do this” style and his obvious experience with how utterly unprepared companies are to make strategic pricing decisions. It is not always the sales guys fault that they ask for all those discounts to get the sale. There are numerous approaches, tactics and assumptions that companies can use to be fully ready well before the sales guy has to sell. Once sales guys sell (and get comp’d) on value, they will start to complain about all the ways the company fails to deliver on their value promise, which will make you a better company.

Related articles

- Getting Your Pricing Right – A BCTIA Panel Discussion in Vancouver (leveragepoint.com)

- Resources on Value Management for Product Development, Pricing, Marketing and Sales (leveragepoint.com)

- Sales and Marketing Alignment (demandmetric.com)

Category: Communication, Finance, Leadership, Management, Marketing, Sales, Strategy